- Procurement Decision-Making Process The procurement of construction machinery (for both engineering projects and trade needs) is typically a rigorous, lengthy, and multi-departmental strategic decision-making process. It generally consists of the following stages:1. Demand Identification and Project Initiation

· Trigger Points: New project launches, replacement of aging equipment, capacity expansion, technology upgrades, and environmental policy responses.

· Internal Assessment: Clarifying the procurement budget, equipment type, technical specifications, quantity, and expected rate of return.

2. Information Gathering and Initial Supplier Selection Channels

- Industry Exhibitions: Bauma Germany, CONEXPO USA, and INTERMAT France are among the world’s top construction machinery exhibitions, serving as key platforms for acquiring information and establishing connections.

· B2B Platforms and Search Engines: Search for brand and product information on platforms like Google, Facebook, and Alibaba.

· Peer Recommendations and Word-of-Mouth: Existing partners and industry-wide word-of-mouth are crucial indicators of trust.

· Professional Media and Industry Reports: Understand industry trends and brand rankings through authoritative magazines like International Construction and KHL.

· Build a Supplier Longlist: At this stage, leading Chinese brands like Machi, Sany, XCMG, Zoomlion, and Liugong are typically already on their radar.

3. Request for Quotes and Proposal Evaluation

· Send Request for Quotes: Send a detailed RFQ to shortlisted suppliers, including technical specifications, commercial terms, and delivery requirements.

· Proposal Evaluation: The customer will comprehensively evaluate:

· Technical Solution: Whether the product meets or exceeds their technical requirements.

· Price: This includes not only the bare metal price but also the total cost of ownership, including freight, insurance, and taxes.

· Commercial Terms: Payment method, delivery time, warranty period, etc.

· Company Strength: Factory size, R&D capabilities, quality system certification.

4. Negotiation and Review

· Technical Clarification and Negotiation: In-depth communication on product details and customization requirements.

· Factory Audit: For major clients or projects, we typically send personnel or commission a third party to conduct a factory audit to firsthand verify the production process, quality management system, and R&D capabilities.

· Final Business Negotiation: Finalize the final price, payment terms, after-sales service terms, etc.

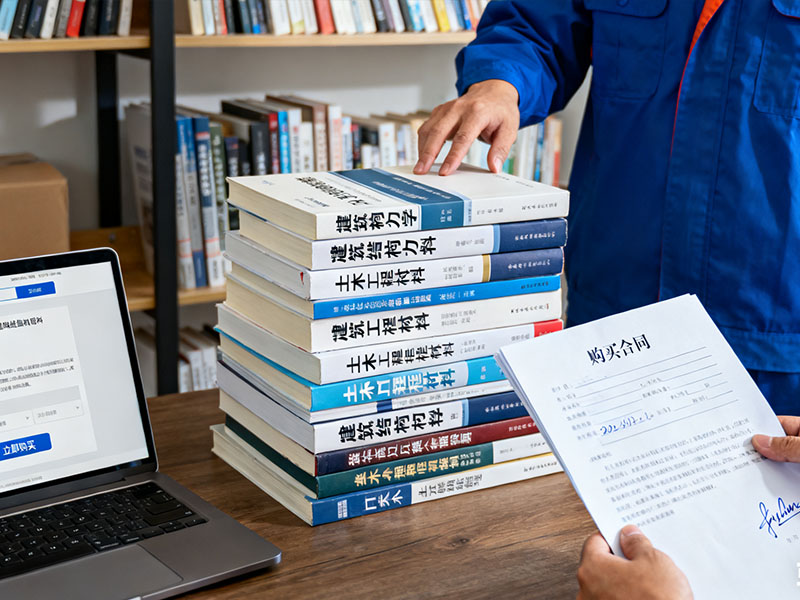

5. Decision-making and Contract Signing

· Comprehensive Evaluation: Procurement, technical, and financial departments jointly make a decision to select the supplier with the highest overall value, not necessarily the lowest price.

· Contract Signing: Contracts are typically very detailed to avoid potential disputes in the future.

6. Contract Performance and Post-Sales Evaluation

· Equipment Delivery and Acceptance: Focus on on-time delivery and equipment integrity.

· After-Sales Service: Installation and commissioning, operator training, troubleshooting response speed, and spare parts availability are key factors in determining repeat purchases and establishing long-term relationships.

Performance Evaluation: Customers continuously evaluate suppliers based on equipment performance, failure rates, and after-sales service quality.II. Key Concerns for Construction Machinery (Factors Influencing Purchasing Decisions) 1. Product Competitiveness

Quality and Reliability: This is key to breaking the stereotype of “Made in China = Low Quality, Low Price.” Whether the equipment can operate stably under harsh conditions and whether the failure rate is low.

Technical Performance: Efficiency, fuel economy, intelligence level, and environmental emission standards. Whether it can meet the stringent Stage V/Tier 4 Final emission standards in Europe and the United States is a key to entering the high-end market.

Cost-effectiveness: While ensuring quality and performance, competitive pricing is the greatest advantage of Chinese brands.

- Total Cost of Ownership

· Construction machinery companies are increasingly focused on Total Cost of Ownership (TCO), not just the purchase price. TCO includes:

· Initial purchase cost

· Operating cost

· Maintenance cost

· Spare parts cost and availability

· Equipment residual value

3. Brand Reputation and Trust

· Brand awareness, reputation, and track record in the international market.

· Successful global or local application cases, particularly in high-profile projects.

4. After-Sales Service and Parts Support

· This is paramount! Construction machinery companies are extremely concerned about:

· Localized service network: Are there offices, service centers, and authorized dealers in the target country?

· Parts availability: Is there sufficient spare parts inventory? What is the order fulfillment cycle? Can urgent parts be delivered quickly?

· Technical service team: Are there local, professional technical engineers to provide support and training?

· Warranty policy: Are the warranty terms clear and competitive?

5. Commercial Terms and Risk Management

· Payment methods: They tend to prefer safer, risk-sharing methods.

· Delivery time: On-time delivery is crucial to their project progress.

· Financing Support: For large-scale purchases, whether a manufacturer or its partnering financial institution can offer flexible financing and leasing solutions is a strong competitive advantage.

· Contract Rigor: Contracts must have clear terms and conditions, clearly defined responsibilities, and compliance with international practices and local laws. III. Recommendations for Chinese Construction Machinery Suppliers :

To address the above customer needs, Chinese manufacturers should improve in the following areas:1. Market Positioning and Product Strategy

· Differentiated Competition: Avoid price wars in all markets. Emphasize technology and quality in high-end markets; emphasize cost-effectiveness and adaptability in emerging markets.

· Compliance First: Ensure products meet the safety, environmental, and certification standards of target markets.

2. Build a comprehensive “Product + Service” solution

· Vigorously develop localized overseas operations: Establish subsidiaries, parts centers, and training centers. Make customers feel you’re right there with them.

· Digitally Enabled Services: Leverage IoT technology to provide value-added services such as remote equipment monitoring, fault warnings, and intelligent scheduling, reducing customers’ Total Cost of Ownership (TCO).

· Flexible Financing Solutions: Collaborate with financial institutions to help customers resolve funding issues.

3. Brand Building and Communication

· Telling the Chinese Brand Story: Showcase the company’s technological strength, modern factories, and global success stories through international exhibitions, industry media, and social media.

· Transparent Communication: Proactively provide detailed technical documentation, certifications, and third-party inspection reports to build trust.

4. Channel Management

· Developing and Supporting High-Quality Distributors: Distributors are an extension of our service reach. They must undergo rigorous screening and systematic training to ensure they represent the brand image and service standards.

· Managing the relationship between direct sales and distributors to avoid channel conflicts.

IV. Targeting the Characteristics of Different Regional Markets

· High-end European and American markets: They are not price-sensitive and place great emphasis on brand, technology, reliability, environmental protection, and after-sales service. They have high barriers to entry and complex certification processes.

· Belt and Road and Emerging Markets: They are price-sensitive and prioritize product durability and adaptability to harsh operating conditions. The after-sales service network is still under development. Whoever establishes a comprehensive service system first will seize market share.

· Middle Eastern markets: They value brand and reliability, and have high requirements for adaptability to high temperatures and windy, sandy environments.

African market: Price is the primary factor, but demand for equipment durability and easy maintainability is extremely high, as repair conditions can be poor.

China’s construction machinery industry has a clear brand structure, and understanding the positioning and characteristics of each brand is crucial for purchasing decisions.