New foreign trade regulations in October:

Starting October 1st, export agents must declare the actual cargo owner’s information in real name.

“Regulations on the Reporting of Tax-Related Information by Internet Platform Enterprises” have been implemented.

China officially launched the world’s first Arctic express container route connecting China and Europe.

Shanghai has recently introduced 13 measures to promote used car exports.

Trump announced high tariffs on imported building materials, furniture, and pharmaceuticals.

The United States has increased port fees for Chinese ships.

The UK has updated its import guidelines for composite products.

Russia has launched a pilot program for mandatory labeling of daily necessities.

Brazil has approved 15 key imports. Zero tariffs on imported goods and extension of protective measures for some industries

Cuba extends zero tariff policy for livelihood sectors until 2026 and removes import restrictions

Kenya Revenue Authority relaxes rules of origin

Iraq requires certificates of origin to include QR codes

Iran’s new customs regulations simplify the import process for cars

India raises tax on clothing priced over 2,500 rupees to 18% effective September 22

Philippines extends e-commerce trust mark registration period to December 31

South Korea strengthens inspections of phenacetin in imported livestock products

Jordan implements safeguard measures on imported safety shoes

Starting October 1st, export agents must declare the actual owner of the goods in real name.

On October 1st, 2025, the State Administration of Taxation’s “Announcement on Optimizing Corporate Income Tax Prepayment and Filing” (No. 17 of 2025) officially came into effect.

This provision clarifies that enterprises exporting goods through agents (including market procurement trade, comprehensive foreign trade services, etc.) must simultaneously submit basic information about the actual consigned exporter and the export amount when making prepayment declarations. Failure to accurately submit such information will result in the enterprise being treated as self-operated and responsible for the corporate income tax payable on the corresponding export amount. The actual consigned exporter refers to the entity that actually produces and sells the goods.

Announcement No. 17 also reminds exporters that the state is strengthening its oversight of export enterprises and requires them to comply with policies, operations, and declarations. Revenue must be promptly and accurately declared after the goods are exported. Revenue from export agents must be confirmed by the actual consignee, and “buying orders” also require confirmation from the actual consignee. If the tax authorities discover that the agent is unaware of or unwilling to disclose the true owner of the goods, the agent will be held liable for tax evasion. We will resolutely crack down on fraudulent exports, exporting with paid-for goods, understating the value of goods, and failing to confirm revenue on time.

Original Notice:

The “Regulations on the Reporting of Tax-Related Information by Internet Platform Enterprises” has been implemented.

Starting from October 1st, in accordance with the relevant requirements of the “Regulations on the Reporting of Tax-Related Information by Internet Platform Enterprises” issued by the State Council, internet platform enterprises will, for the first time, formally report the identity and income information of operators and employees on their platforms.

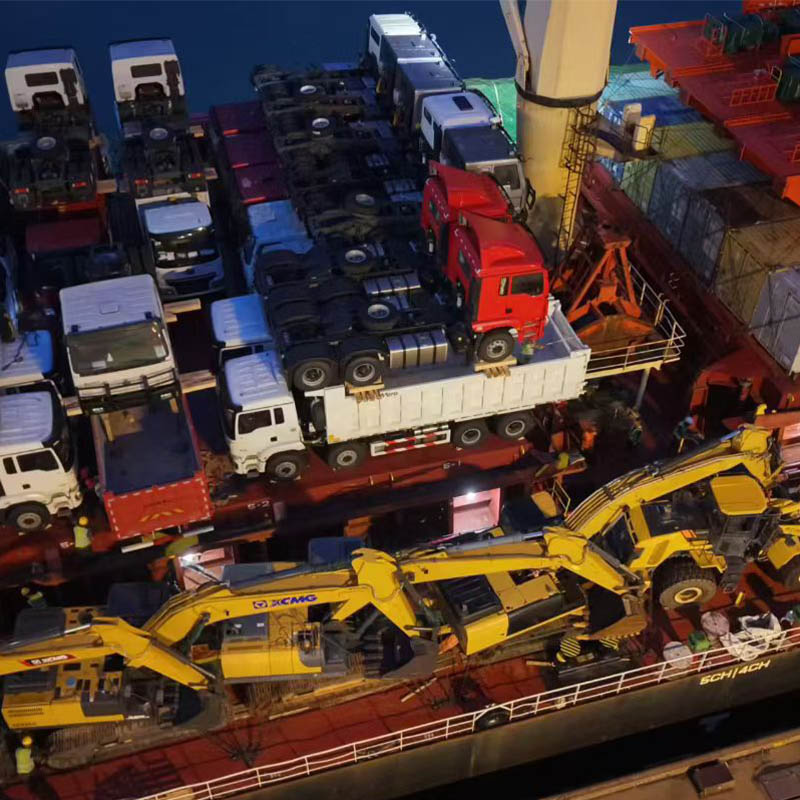

China officially launches the world’s first Arctic express container route connecting China and Europe.

On September 23rd, China officially launched the world’s first Arctic express container route connecting China and Europe, with a journey time of just 18 days. The Ningbo Municipal Government of Zhejiang Province announced that the inaugural vessel, the “Istanbul Bridge,” has departed from Ningbo Zhoushan Port, China’s largest port, bound for Flixtow, UK. The route reportedly takes the Northeast Passage through the Arctic, directly to Europe via the Bering Strait, significantly shortening travel time compared to traditional routes and reducing carbon emissions by approximately 50%.

Shanghai has recently introduced 13 measures to boost used car exports.

Shanghai has recently formulated the “Shanghai Action Plan to Promote Used Car Exports” (hereinafter referred to as the “Action Plan”), setting the above-mentioned new targets. The scale of used car exports is a significant increase compared to the target set last July. Last July, the “Shanghai Action Plan to Accelerate Automobile Renewal Consumption (2024-2027)” proposed reducing the average age of used cars traded in Shanghai by one year by 2027. Used car exports are expected to reach 15,000 units, doubling the 2023 target.

To achieve these goals, the Action Plan proposes 13 measures covering four areas: building a comprehensive service platform for used car exports, supporting the expansion of used car exports, enhancing export facilitation, and improving service guarantees.

Trump Announces High Tariffs on Imported Building Materials, Furniture, and Pharmaceuticals

On September 25th, local time, US President Trump announced on his social media platform, “Real Social,” that the United States will impose a new round of high tariffs on a variety of imported products, effective October 1st. The measures include:

50% tariffs on kitchen cabinets, bathroom vanities, and related building materials;

30% tariffs on imported furniture;

100% tariffs on patented and branded pharmaceuticals;

25% tariffs on all imported heavy trucks.

The United States will impose additional port fees on Chinese ships.

On August 12, 2025, the Office of the United States Trade Representative (USTR) officially announced the “Final Measures of the Section 301 Investigation into China’s Maritime, Logistics, and Shipbuilding Industries.” Effective October 14, 2025, additional port fees will be imposed on Chinese-built or operated vessels. Violators will be barred from docking.

Implementation Phases:

Phase 1 (October 2025 – April 2028): Focus on mainstream ship types such as container ships and bulk carriers, charging by tonnage or container.

Phase 2 (after April 2028): Expand to liquefied natural gas (LNG) carriers, restricting foreign vessels from participating in U.S. energy transportation.

The UK has updated its guidance for composite product imports.

On September 19, 2025, the UK Department for Environment, Food and Rural Affairs (DEFRA) website announced that the UK has updated its guidance for composite product imports, adjusting the weight reporting for composite products in the Imported Products, Animals, Food and Feed System (IPAFFS).

Specific requirements: When submitting an import notification for a composite product, you will no longer need to provide a separate commodity code and weight for each component of the composite product. You can now provide a single commodity code and total weight for the entire composite product.

This rule applies to both mixed composite products (e.g., meatballs containing eggs) and separated composite products (e.g., a separate cheese and meat platter). Although individual component weights are not required, the “total product weight” reported in PAFFS, as well as any required health certificates and customs declarations, must be consistent. If you still choose to report the weight/quantity of each component in IPAFFS, these data should be consistent with the customs declaration.

Russia Launches Pilot Program for Mandatory Labeling of Daily Necessities

The Russian government has approved an 11-month trial of mandatory labeling for daily necessities, starting September 25, 2025. This trial will cover personal care and household items such as manicure sets, dental floss, towels, combs, and washcloths. This trial, based on the “Honest Labeling” system (Честный Знак), requires participation from manufacturers, importers, and retailers, aiming to establish a unified labeling model and coding standards. The trial will run until August 31, 2026.

In addition, a pilot program for household items such as tableware, detergents, and decorative items will also begin on October 1.

This initiative is part of Russia’s 2030 consumer protection strategy. The existing labeling system already covers 18 categories of goods, including food, clothing, and medicine, to combat illegal distribution and counterfeiting.

Brazil Approves Zero Tariffs on 15 Key Imported Goods and Extends Protection Measures for Some Industries

The Executive Management Committee of the Brazilian Foreign Trade Commission (Gecex-Camex) held its 229th regular meeting on September 23rd and approved import tariff reductions on 15 goods not produced in Brazil. The Commission stated that these products are critical to various domestic production chains and will help enhance the competitiveness of the country’s industry.

The tariff reductions include certain types of lithium-ion batteries (the tariff rate has been reduced from 18% to zero), automated chest compression resuscitation systems (from 12.6% to zero), certain electrical connectors for printed circuit board soldering (from 16% to zero), and high-hardenability chromium-molybdenum steel pipes (from 14.4% to zero).

Cuba Extends Zero Tariff Policy on Consumer Goods Until 2026 and Removes Import Restrictions

To address domestic supply shortages, the Cuban government announced that it will extend its zero tariff policy on consumer goods, including food, hygiene products, medicines, and medical supplies, until January 31, 2026, and will remove import value restrictions. This move stems from the country’s ongoing economic difficulties, particularly the shortages of goods caused by the COVID-19 pandemic. The new measures also expand duty-free access for medical equipment, raw materials, and pharmaceuticals, while maintaining the US$200 (approximately 200,000 Cuban pesos) tax exemption for individuals.

Kenya Revenue Authority Relaxes Rules of Origin

The Kenya Revenue Authority (KRA) has relaxed a new regulation requiring all imported goods to be accompanied by a Certificate of Origin (CoO), effective October 1, 2025. Tax officials have also opened a window where, in exceptional cases where a CoO is not available, alternative customs clearance documents can be accepted. These include a Declaration of Origin detailing the country of origin, an export permit or license issued by the competent authorities of the exporting country, a customs export declaration from the exporting country, or a pre-verified certificate of conformity issued by an agent accredited by the Kenya Bureau of Standards. To further ease the burden on importers, KRA has exempted 10 product categories, including second-hand goods, from the CoO rule.

Iraq Requires Certificates of Origin to Include QR Codes

On September 4, 2025, according to the website of China’s Ministry of Commerce, the Iraqi Ministry of Trade will require that products exported to Iraq must be issued with certificates of origin printed with QR codes. The QR codes should contain all product information. Iraq will use QR codes as the basis for certification, recognizing “codes, not seals.” This decision will take effect on August 10, 2025.

Iranian Customs Regulations Simplify Car Import Process

Iran News Agency reported on September 16 that new Iranian customs regulations, effective September 15, ease restrictions on car imports and simplify the import process to promote vehicle imports. These regulations include eliminating the need for separate vehicle standard permit applications and granting a one-year registration validity period for orders for vehicles with engines under 2.5 liters. Tahmasabi, Governor of the northeastern province of Golestan, stated that he had met with the Director-General of the Iranian Customs Administration and reached an agreement to establish a dedicated platform for car imports at the province’s Yinchebulon border crossing.

India’s tax rate on clothing priced over 2,500 rupees per item will rise to 18% starting September 22nd.

Indian Prime Minister Narendra Modi implemented the largest tax reform in eight years, adjusting the Goods and Services Tax (GST).

Specific to the apparel industry, the new Indian tax regulations stipulate that starting September 22nd, the GST on clothing and clothing accessories priced over 2,500 rupees (approximately RMB 202.22) per item will increase from 12% to 18%. Apparel priced under 2,500 rupees will be subject to a minimum tax rate of 5%. For footwear, the tax rate on shoes priced under 2,500 rupees will be reduced from 12% to 5%, while the tax on shoes priced above 2,500 rupees will remain at 18%.

Philippines E-commerce Trustmark Registration Extended to December 31st

The Department of Trade and Industry (DTI) announced that the registration deadline for the e-commerce Trustmark will be extended from September 30th to December 31st to allow more small and medium-sized enterprises to complete certification. As of September 19th, 10,057 companies had submitted applications, with major platforms such as TikTok, Lazada, and Shopee already receiving certification.

South Korea Strengthens Inspections of Phenacetin in Imported Livestock Products

On September 8, 2025, South Korea’s Ministry of Food and Drug Administration (MFDS) issued a notice strengthening inspections of phenacetin in imported livestock products. Key details: Imported livestock products (all meat and by-products, and edible eggs) will be inspected for phenacetin, with a detection limit of no detectable levels. Inspections will begin on shipments starting October 1, 2025.

Jordan Implements Safeguard Measures on Imported Safety and Protective Footwear

On September 2, 2025, the WTO Committee on Safeguards published a safeguard notification submitted by the Jordanian delegation. The Jordanian Council of Ministers issued a notice imposing safeguard duties on imported safety and protective footwear for a period of three years, effective September 1, 2025. The duties are as follows:

JOD 5.75 per pair from September 1, 2025, to August 31, 2026; JOD 5.50 per pair from September 1, 2026, to August 31, 2027; and JOD 5.25 per pair from September 1, 2027, to August 30, 2028. The products involved are under tariff numbers 6402, 6403, 6404, and 6405.